Examine Housing Affordability Trends in Tucson, Arizona MSA

Examine Housing Affordability Trends in Tucson, Arizona MSA

How are we doing?

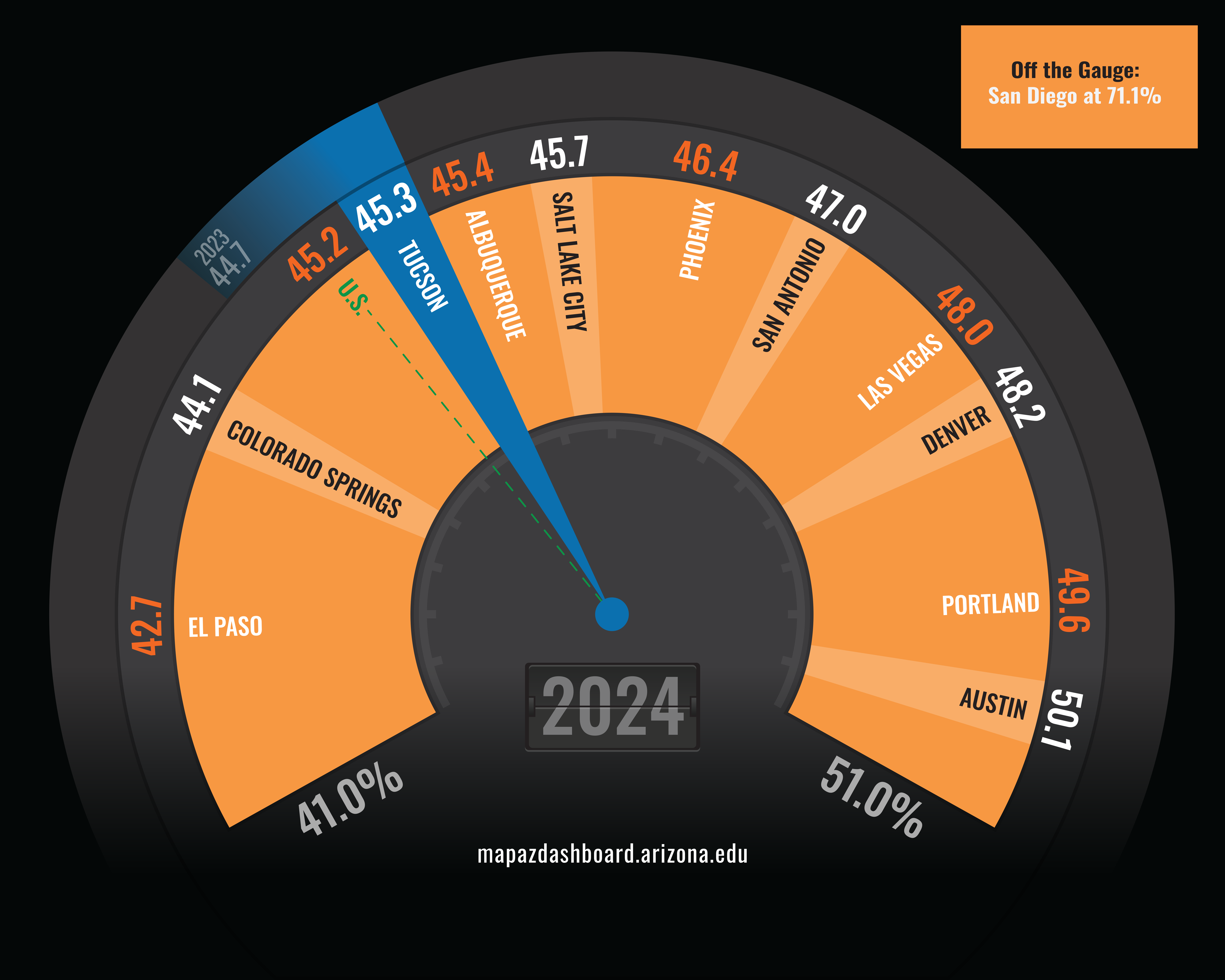

Housing Affordability (2024)

Share of Household Median Income Needed to Afford Median Priced Home

In 2024, a household earning the local median income in the Tucson Metropolitan Statistical Area (MSA) would need to spend 45.3% of their annual income to afford the median-priced home. Nationally, the share of income required to afford the median-priced home was near a record high at 45.2%. Tucson ranked relatively well among peers, with the third-lowest share of income needed to afford a median-priced home. However, the housing affordability cut-off is 30%. That means when the share of income needed to buy a home is greater than 30%, it is considered unaffordable. Historically, when housing expenditures exceed 30% of a household's income, they are cost-burdened and often struggle to pay for other basic needs such as healthcare, childcare, transportation, and even food.

Why is it important?

Housing affordability is an important issue for many households. Access to affordable housing is essential because the home is often the largest asset for most people, and its price can affect spending in other areas such as childcare, education, health care, and leisure activities. Historically, when housing expenditures exceed 30% of a household's income, they are cost-burdened. This designation evolved from the United States National Housing Act of 1937. Since personal consumption makes up the better part of the economy, and the cost of housing influences discretionary income levels, home prices are an important factor in the local economy. Several factors can affect home prices, including mortgage rates, demographics, income growth, the supply of new housing, and speculative trends. Housing affordability is determined by the share of income a household earning the local median income would need to afford the locally priced median home. Housing affordability data comes from the Federal Reserve Bank of Atlanta.

How do we compare?

The share of income needed to afford the median-priced home has varied widely in Tucson over the past twenty years. When the share of income required is less than 30%, the median-priced home is considered affordable for a household earning the median income. In Tucson, the highest share of income needed to afford the median-priced home occurred just before the Great Recession. In 2006, someone earning the median household income had to spend 49% of that income to afford a median-priced home. That share fell drastically as home prices decreased and mostly stayed below the 30% affordability cut-off from 2009 to 2021. Since 2021, home prices have increased faster than wages. That, coupled with higher interest rates, has pushed the share of income needed to afford the median-priced home above the affordability threshold. Despite the low affordability rate, Tucson has remained one of the most affordable regions to purchase a home compared to peer western MSAs.

Use the drop-down menu above the graph to view housing affordability trends for Tucson's other peer geographies.

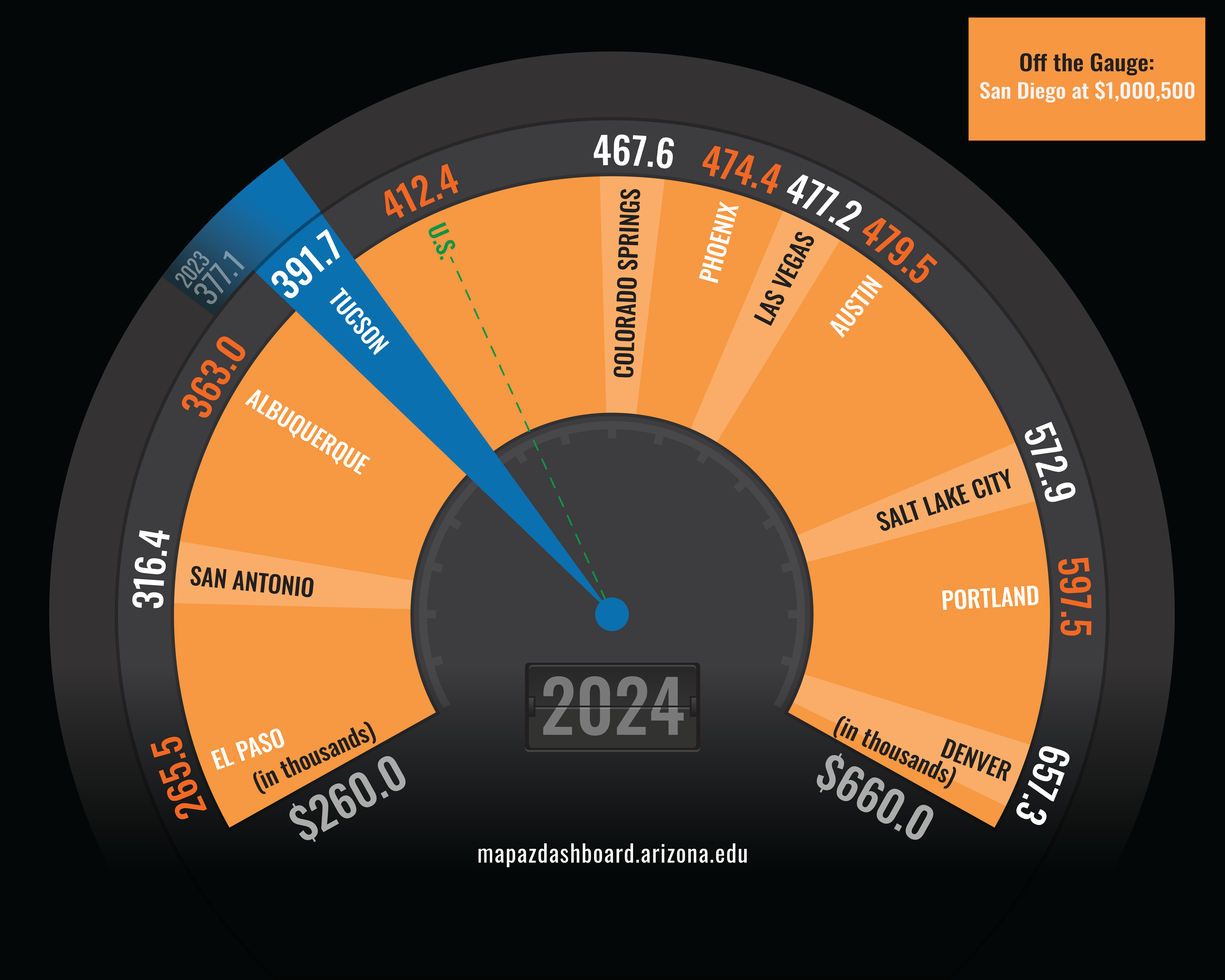

Home prices nationwide have increased rapidly over the past few years due to strong demand and limited supply. Home prices cooled in the second half of 2022 due to spiking interest rates. However, recent data for Tucson suggests that was only temporary, with home prices increasing by 3.9% between 2023 and 2024. Tucson reached a new all-time peak in the median sales price of a single-family home of $391,700 in 2024. Tucson has a relatively low median home price compared to peers. San Diego's median home price reached more than $1 million in 2024. Tucson's median home price remains below the nation's.

Median Home Price (2024)

What are the key trends?

Tucson has followed a similar trend as the nation, with a high share of income needed to purchase the median-priced home before the Great Recession. As home prices dropped during the Great Recession, the share of income required fell below the affordability threshold of 30%. Tucson remained below that threshold for over a decade, much longer than the nation. In 2021, home prices and interest rates rose faster than wages, which in turn increased the share of income needed to purchase a median-priced home. The share of income required by households in Tucson to afford a median-priced home rose above the threshold in early 2021 and has since remained there. In November 2025, the share of income needed to purchase a median-priced home for someone in Tucson earning the median household income was 41.6%, below the national share (42.7%) and Phoenix’s share (43.6%).

How is it measured?

Housing affordability data comes from the Federal Reserve Bank of Atlanta. The Home Ownership Affordability Monitor (HOAM) provides a monthly measure of the median-income household's ability to afford the median-priced home. HOAM considers the monthly principal and interest cost, current mortgage interest rates, and the costs associated with taxes, property insurance, and private mortgage insurance. HOAM uses the U.S. Department of Housing and Urban Development (HUD) standard 30 percent share of income threshold to measure affordability. The HOAM uses median household income values from the U.S. Census Bureau, median sales price data from Zonda Home, and 30-year fixed mortgage rates from Freddie Mac while assuming a down payment of 10%. Private mortgage insurance (PMI) is estimated at 0.558% of the mortgage amount. The data is reported monthly, and the Making Action Possible (MAP) research team aggregates the data to an annual value.